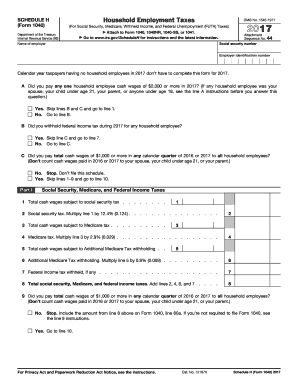

schedule h tax form 2020

Complete Schedule H 100W Part II and enter the total. Complete IRS Tax Forms Online or Print Government Tax Documents.

Irs Schedule H 1040 Form Pdffiller

Quarterly forms ST-100 series.

. Reporting the Credits for Qualified Sick and Family Leave Wages in Gross Income on Schedule 1 Form 1040-- 01-MAR-2021. January 1 - December 31 2020. Schedule H 100 2020 783120 3 I J - I I 7 TAXABLE YEAR 2020 Dividend Income Deduction CALIFORNIA SCHEDULE H 100 Attach to Form 100.

Enter the amount of social security tax from Schedule H Form 1040 Part I line 2a. 1 00 - only if divorce. Form 965 Schedule H Amounts Reported on Forms 1116 and 1118 and Disallowed Foreign Taxes 1220 11132020 Form 990 Schedule H Hospitals 2021 11192021 Inst 990 Schedule.

Fill out all the necessary lines on this schedule Include all household income see pages 10 to 17 Sign and date the schedule Attach your property tax bill or rent certificates If disabled and. 1 Homeowners fill in the net 2020 property taxes on your homestead or the amount from line 3 of Schedule 2. Schedule h certification of permanent and total disability TAXPAYERS WHO ARE DISABLED DURING 2020 REGARDLESS OF AGE If you were certifi ed by a physician as being permanently.

Office of Tax and Revenue. Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Form W-2 for reporting wages paid to your employees.

This form is for income earned in tax year 2021 with tax returns due in April 2022. Attach additional sheets if necessary. Ad Complete IRS Tax Forms Online or Print Government Tax Documents.

From within your TaxAct return Online or Desktop click Federal. Include the amount from line 8d above on Schedule 2 Form 1040 line 9. Extension of time to file.

For sales tax year - March 1 2020 through February 28 2021. If updated the 2021 tax year PDF file will display the prior tax year. Corrections to 2020 Instructions for Form 1040 Schedule H Line 27-- 24-MAY-2021.

Include the amounts if any from line 8e on Schedule 3 Form 1040 line 13b and line 8f on Schedule 3 Form 1040 line 13h. Office of Tax and Revenue. Monday to Friday 9 am to 4 pm except District holidays.

Multiply line 1a by 50 050 1b _____ 1c. To enter the data for Schedule H for Household Employment Taxes into TaxAct. And 14 of Schedule H.

Revised 2021 Instructions for Schedule H Form 1040-- 16-FEB-2022. Enter the amount of social security tax from. Form W-3 for sending Copy A of Forms W-2 to the Social Security Adminis-tration SSA.

Petroleum business tax and Publication 532. Annual Schedule H - Report of Clothing and Footwear Sales. 1101 4th Street SW Suite 270 West Washington DC.

Schedule H Form 1040 for figuring your household employment taxes. Motor fueldiesel motor fuel monthly and quarterly March 1 2019 through February 29 2020 Partnership LLCLLP. Write the dividend payers name and label dividends received from certain foreign construction projects as FCP in Part II column a.

The form will ask you for the total amount of federal income taxes you withheld from your employee the wages you paid them and the state unemployment insurance taxes you paid. Form 1120-H Department of the Treasury Internal Revenue Service US. Round to the nearest whole dollar.

On smaller devices click in. 1 2 Renters if heat. The draft form was revised to accommodate qualified leave wages.

However instructions for the 2020 Schedule H draft have not been. We last updated Federal 1040 Schedule H in January 2022 from the Federal Internal Revenue Service. Corrections to 2020 Instructions for Form 1040 Schedule H Line 27-- 24-MAY-2021.

Count cash wages paid in 2020 or 2021 to your spouse your child under age 21 or your parent No. 2020 Instructions for Schedule HHousehold Employment Taxes Here is a list of forms that household employers need to complete. Instructions for Schedule H-EZ TaxesRent Reduction Schedule 1 Homeowners fill in the net 2020 property taxes on your homestead.

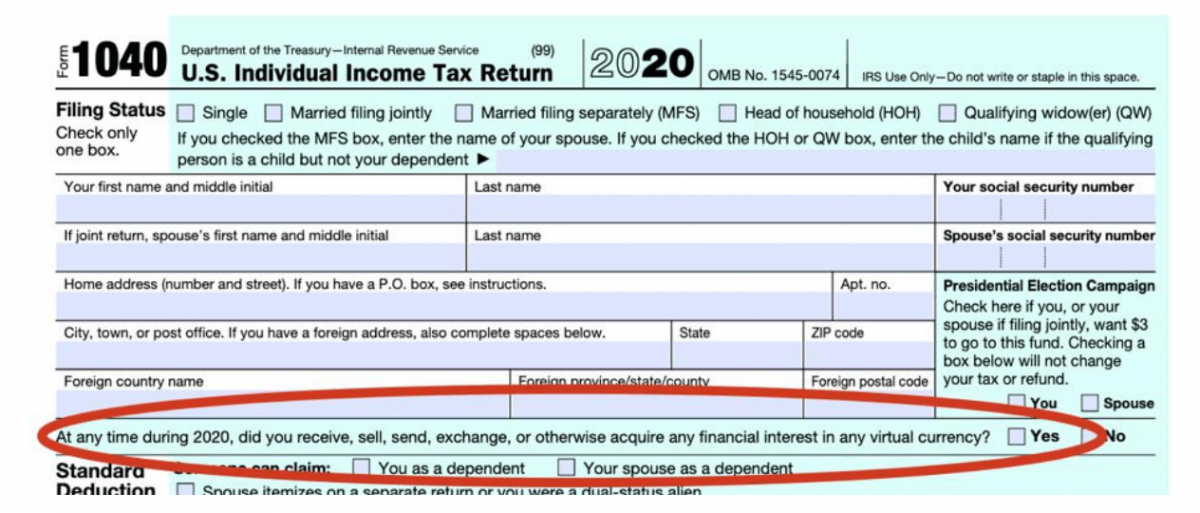

The 2020 Schedule H was updated to include lines for reporting coronavirus-related tax relief. Form 1040s Schedule H is used to report household employment taxes The instructions include guidance on reporting of coronavirus-related tax relief Finalized. Complete Form ST-8107 Quarterly Schedule H for Part-Quarterly Monthly Filers if you file Form ST-810 New York State and Local Quarterly Sales and Use Tax Return for Part-Quarterly.

The 2020 Schedule H draft form points to a Worksheet 3 which would be included in the forms instructions. Ad Download Or Email Form B6H More Fillable Forms Register and Subscribe Now. Income Tax Return for Homeowners Associations Go to wwwirsgovForm1120H for instructions and the latest.

Of Schedule H Section A for credit based on rent paid or Line 10 of Schedule H Section B for credit based on property tax paid. The Schedule H form and instructions booklet are generally updated in November of each year by the IRS. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

:max_bytes(150000):strip_icc()/schedB-7250cc494af24b9fa7dd368806aafcc5.jpg)

Schedule B Interest And Ordinary Dividends Definition

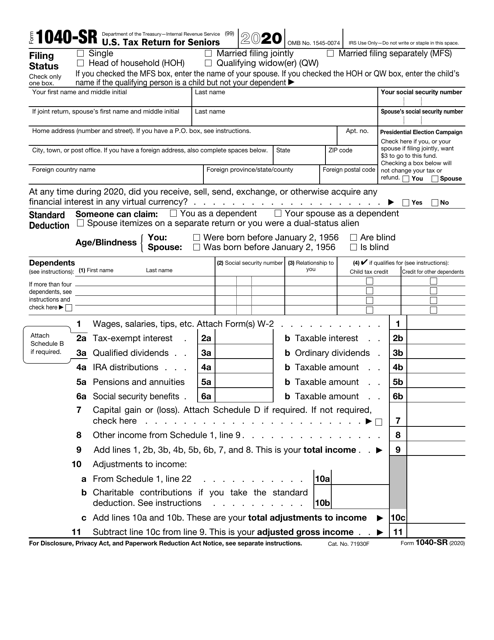

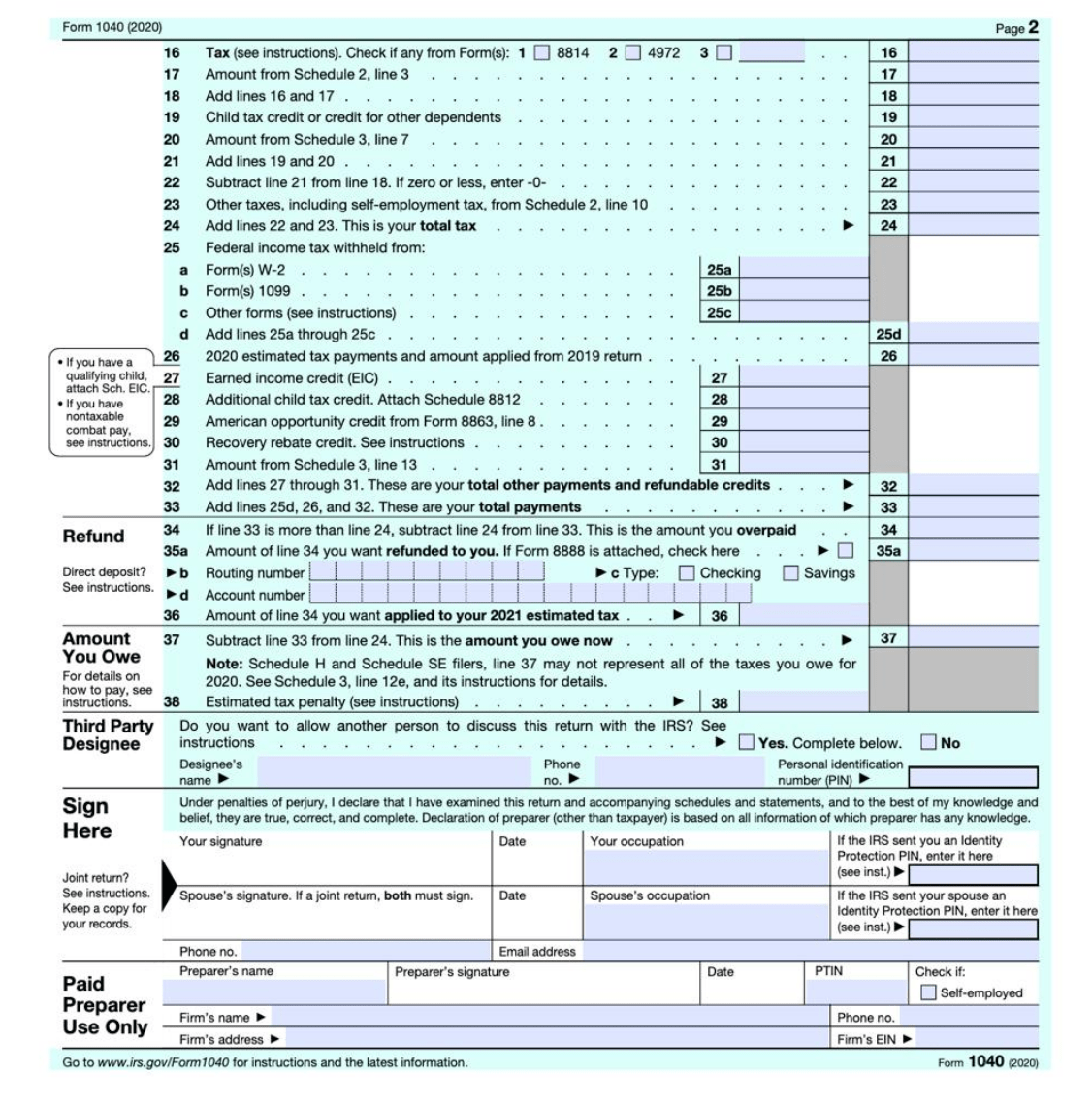

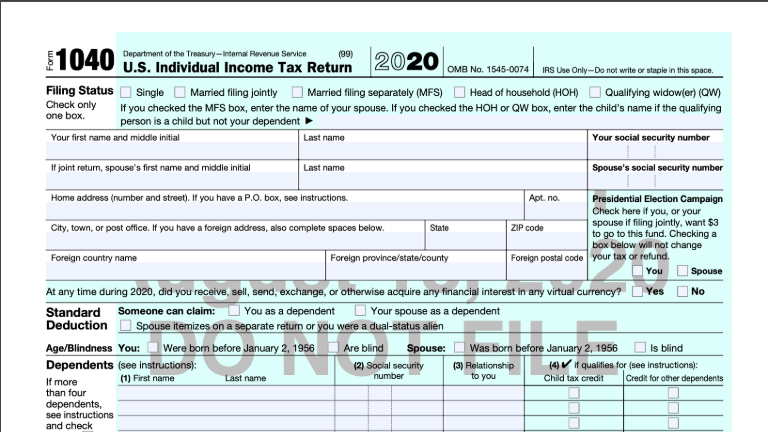

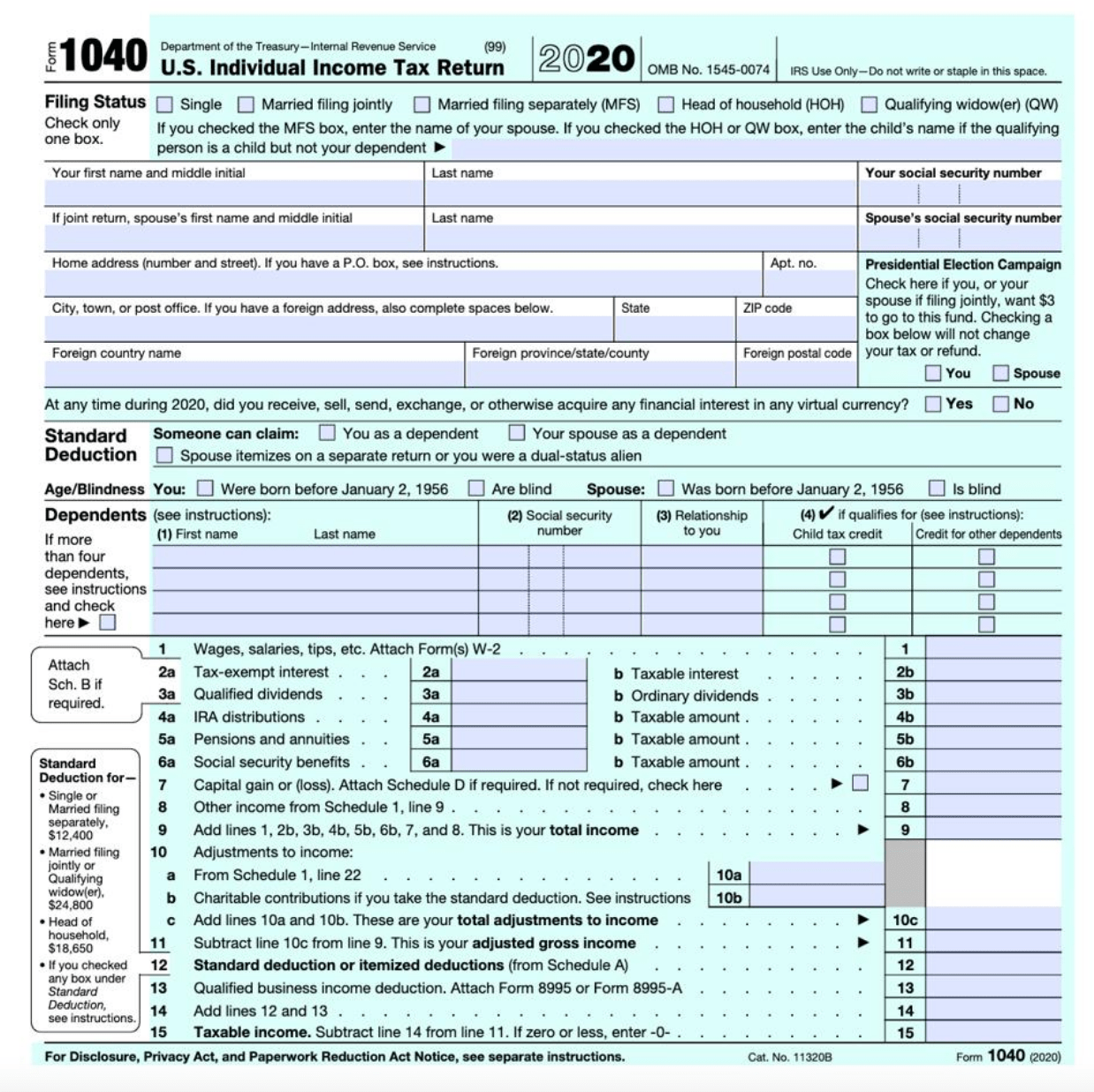

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

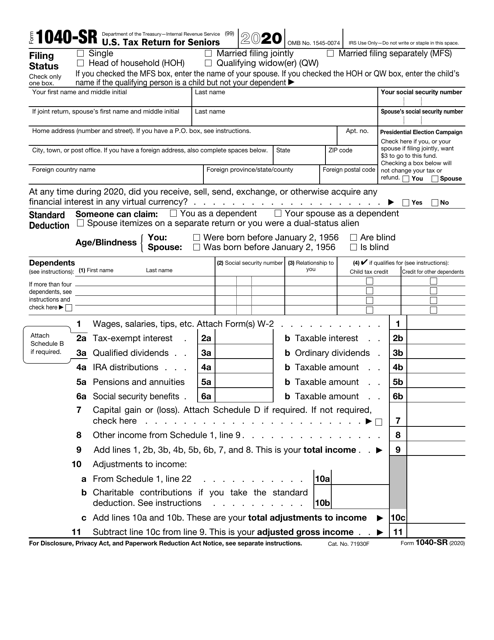

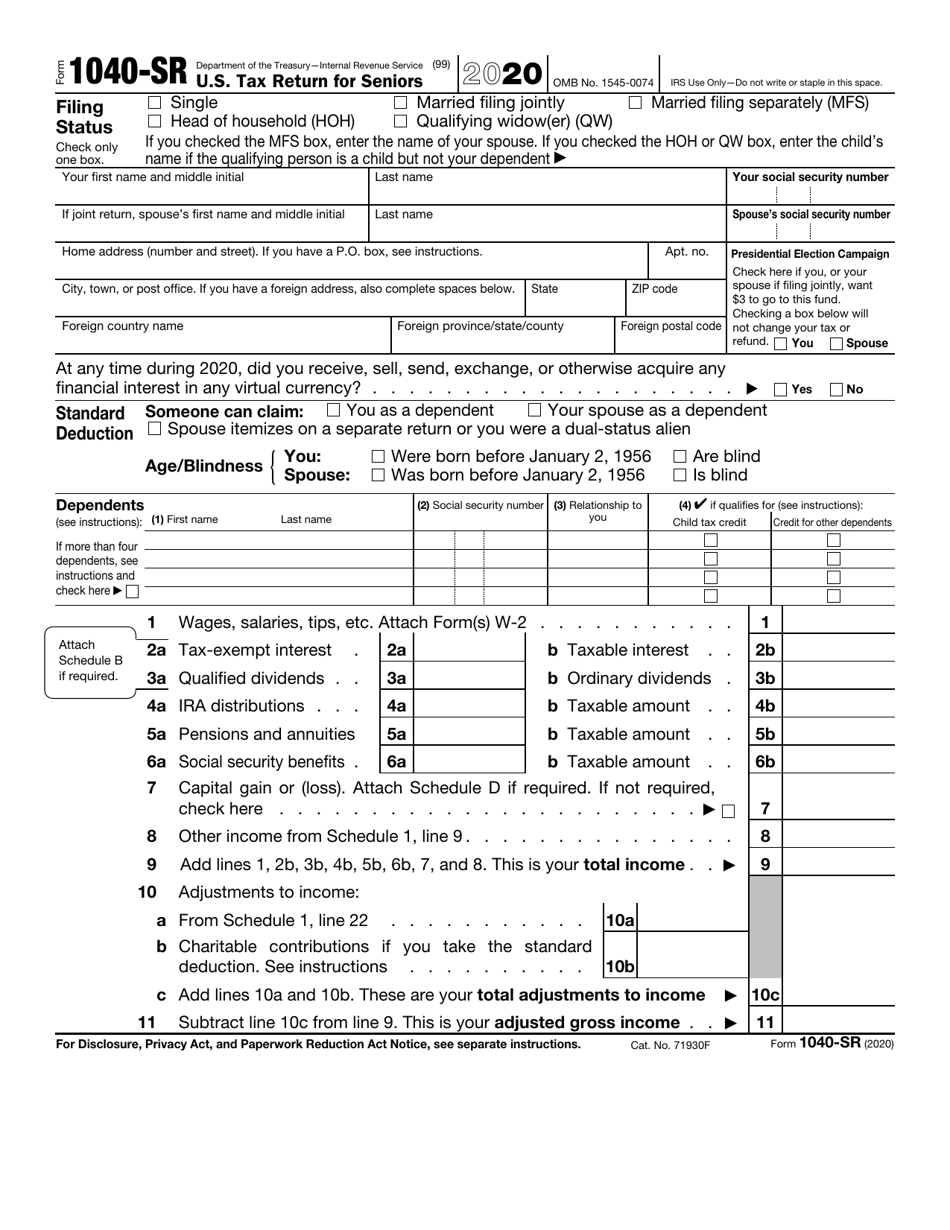

Irs Form 1040 Sr Download Fillable Pdf Or Fill Online U S Tax Return For Seniors 2020 Templateroller

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

2021 Schedule 1 Form And Instructions Form 1040

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

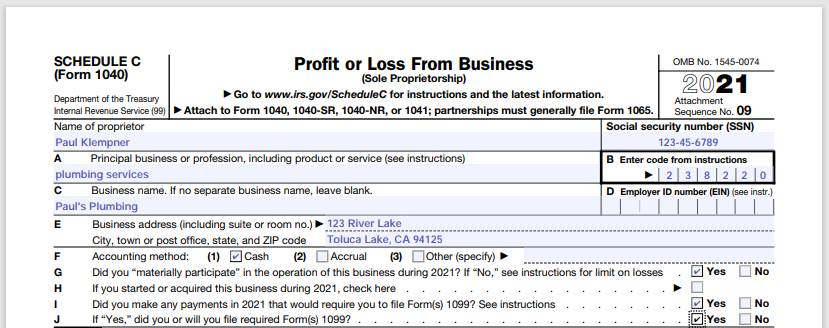

How To Fill Out Your 2021 Schedule C With Example

/ScreenShot2021-02-07at3.03.39PM-69096f457ec344ce9ca4bb158a195baa.png)

When Would I Have To Fill Out A Schedule D Irs Form

Irs Releases Form 1040 For 2020 Tax Year Taxgirl

:max_bytes(150000):strip_icc()/SchedD-59e44eca73a940459e36066f830ebf63.jpg)

Schedule D Capital Gains And Losses Definition

Irs Form 1040 Sr Download Fillable Pdf Or Fill Online U S Tax Return For Seniors 2020 Templateroller

Irs Now Adjusting Tax Returns For 10 200 Unemployment Tax Break Forbes Advisor

Irs 990 Schedule H 2020 2022 Fill Out Tax Template Online Us Legal Forms

/ScreenShot2021-02-06at4.24.16PM-695c2638669a4d1d81d1bfcd47a2d04b.png)